Hong Kong is now ready for innovative supply chain finance solution (with DLT on blockchain)in the apparel industry and perhaps other industries too.

#Blockchain #ESG #TradeFinance #FashionSummit #Apparel #Electronics #SmartCity #Sustainability #SDGs #Inspectrum

Part 1 of 4

By Daniel Chun and Prof. Emil Chan

A business case review article originally published in medium

At the recent Fashion Summit (Sep 2021) held in Hong Kong, a group of thought leaders comprising owner of apparel business, bank manager, NGO leaders, academia, social entrepreneur, Fintech expert and collectively agreed that the apparel industry will be eventually disrupted with a new set of business landscape and financial payment solutions that would essentially offer more transparency on transactions as well as reducing the cost of transactions.

Legendary digital futurist Don Tapscott and his son Alex Tapscott, have once posted a question in their award-winning book “Blockchain Revolution” — arguing that investors would invest in a company with more transparency, shows you what’s going on all the time rather than financial information on a quarterly basis. This is similar to what had been discussed over at this forum at Fashion Summit where Dr. Peter Cheng — Chairman of Hanbo Enterprises Limited(being used to be a listed company in the apparel business) was sharing about the ESG report requirement.

Check this video out about how Dr. Peter Cheng share on the need for data traceability, data authenticity in apparel businesses to support SMEs and other downstream suppliers and factories.

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2Fg8E0qUPAJ6M%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3Dg8E0qUPAJ6M&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2Fg8E0qUPAJ6M%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtubeDr. Peter Cheng — The Importance of data transparency for ESG and Green Finance for SMEs

There have been some notable projects recently in Hong Kong too for supply chain financing using state of the art distributed ledger technologies (DLT) on the blockchain platform. To set the stage for the readers, Standard Chartered Bank through its SC Ventures arm had inked a deal with China based Linklogis (listed in HKEX) with a joint-venture partnership, the new company is now called OLEA and their website is (www.Olea.net)

HKMA’s eTradeConnect — a platform announced in 2018 (click here for details) that is mandated by the Hong Kong Monetary Authority to oversee the project management of the use of blockchain technologies for effective trade finance facilitation for various banks and industries. This project has been commissioned to Hong Kong Interbank Clearing Corporation Limited to pilot test with various industry stakeholders and participating bank partners. In the Smart City Blueprint 2.0, the HKSAR Government finally earmarked this eTradeConnect project (click here to see their portal) as one of the smart city initiatives — in the Smart Economy section. According to the report in Smart City Blueprint 2.0, eTradeConnect has completed Phase 1 of the testing.

Mr. Paul Yeung of HSBC has also shared that HSBC has invested in a startup company called Serai.ai (click here) also targets at solving the trade finance situation with financing of small loans to some of Hong Kong-based small-medium size firms and for their downstream manufacturers and suppliers. Prof. Emil Chan, a well known ex-banker and now a Fintech professor has also summarised “This industry has a well known problem in factoring in handling the payment purchases, hence there is an increasing demand for Fintech solutions to play a role in data governance using Blockchain based solutions and other data-management solutions that support reverse factoring”.

Besides the traditional banks starting to invest into the startup ecosystem deploying resources in innovative Fintech solutions, another startup company called ByFin.com (a SBI company) is doing exactly this using DLT on Blockchain tokens to host the reverse factoring and provides tokens to all downstream stakeholders (e.g. manufacturers and suppliers) involved in the purchase or transactions. The data collected throughout the journey on production could be collected to support the release of payments earlier thereby lowering the cost of borrowing and the risks involved in any given transactions (that previously are handled of Letter of Credit issuance or wire transfers). ByFin positioned itself as a finance enabling platform, please click here to see more.

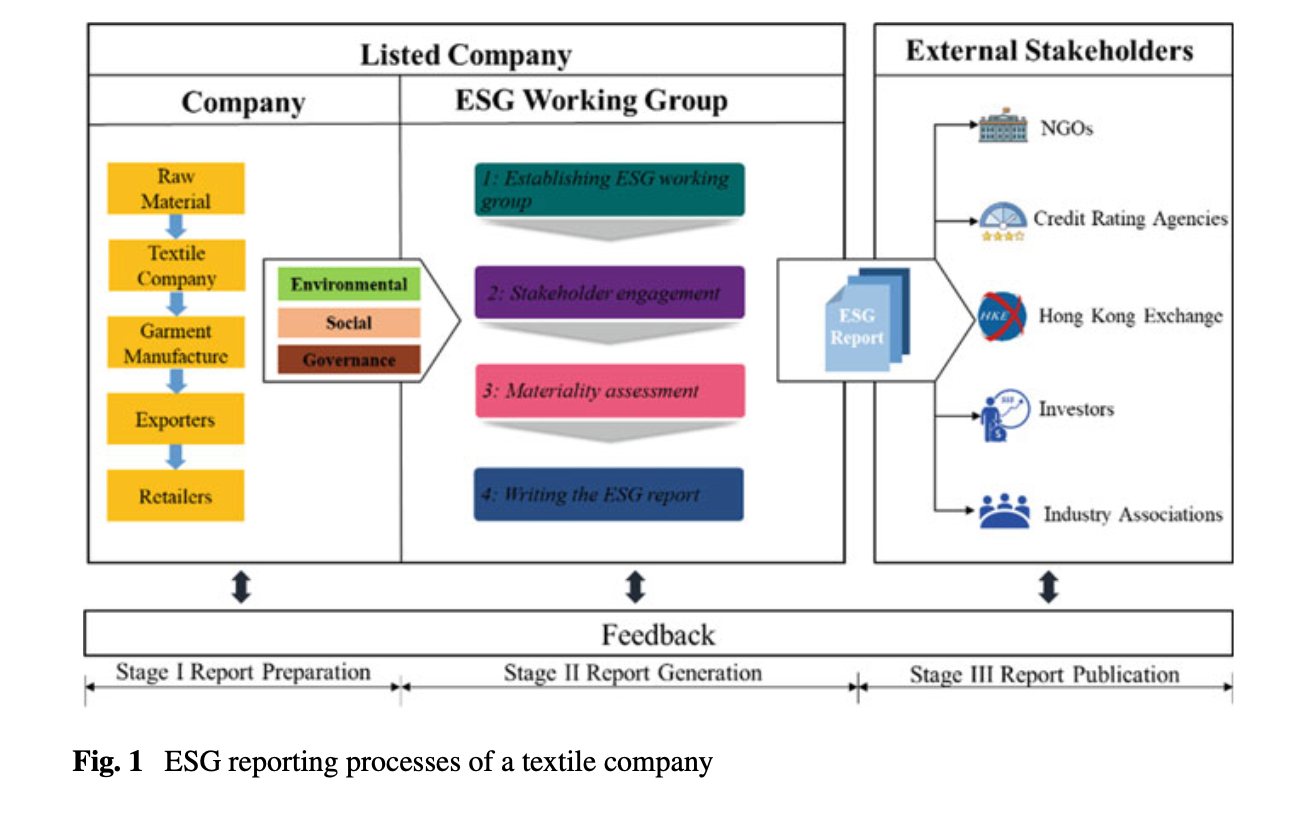

Among the different panel speakers at this forum, Prof. George Huang of the University of Hong Kong is also on stage — an expert in applying blockchain technologies in ESG reporting. He shared with the audience at the Fashion Summit that through a HKSAR Government ITF funded research project for which he is the principal investigator, his research team is enabling the use of blockchain technologies for collecting data in ESG reporting and this project receives matching support funding from the companies like Hanbo and Key-links Data Technology. The idea is to enable the data collection via the use of IoT technologies to accurately collect data, and to allow for accurate reporting with full tracking and tracing capabilities using blockchain. In one of the book chapter, Prof. Huang reported that the ESG reporting will continue to be very challenging citing that standards reporting organisations have their recommendations on reporting format only and very few guidelines as to how to validate the data accuracy, data traceability and data authenticity in supply chain.

Prof. Emil Chan was a moderator at this Green Finance forum — staged at Fashion Summit and other guest speakers such as Ms. Jenny Chow of United Nations UNDP Social Impact Fund, Mr. Hugo Petit of Renewcell, Mr. Paul Yeung of HSBC

The apparel industry will have to transform or face the inevitable death just like what Dr. Peter Cheng once said “Transform or Die as this paradigm shift may also happen in other industries such as toys, electronics and everyday consumer goods where ESG reporting, green finance will need the support from trusted data”.

In conclusion, we would like to borrow the statement from Don Tapscott and Alex Tapscott in their book “Blockchain Revolution” again ( on Page 309) — “We will need institutional transformation across the board … Blockchain technology can enable new physical infrastructure requiring new partnerships and understanding of stakeholders” and (on page 311) “Think about your business, your industry and your job: How will I be affected and what can be done? Do not fall into the trap brought about by many paradigm shifts throughout history. Today’s leaders cannot afford to be tomorrow’s losers. Too much is at stake and we need your help”

Reference

Liu, X., Wu, H., Wu, W., Fu, Y., & Huang, G. Q. (2021). Blockchain-enabled ESG reporting framework for sustainable supply chain. In Sustainable Design and Manufacturing 2020 (pp. 403–413). Springer, Singapore.

About the Authors

Daniel Chun is the Vice President at Smart City Consortium and also chair the Research and Blueprint Committee and a faculty member at HKUST Academy of Interdisciplinary Studies.

Prof. Emil Chan is the Chairman of Fintech Committee at the Smart City Consortium and a teaching faculty at the City University EMBA programme and Fintech evangelist. Emil is also the chairman of the Association of the Cloud and Mobile Computing Professionals and had been publishing his thought leadership in various newspaper journals.