TVB to write off Ztore e-commerce operations ! How leadership matters in listed companies in strategic acquisitions of start-ups

TVB (listed company in HK Stock code 511) now writing off Ztore after spending over HK$200 Million to acquire in 2019 the fame Ztore e-commerce company which had a high valuation. In my opinion, this was a bad decision from the get go. Let me explain why later.

SCMP reported they are losing $647 Million. (Link)

In 2019, Hong Kong broadcaster TVB acquired a 75% stake in local e-commerce platform Ztore for HK$200 million. Ztore operates two e-commerce platforms in Hong Kong, namely ztore.com and neigbuy.com. The acquisition aimed to increase TVB’s e-commerce presence in Hong Kong and tap the massive mainland Chinese market. However, the Ztore business was still at the investment stage and had yet to turn a profit as of the time of the acquisition.

Several factors contributed to the high valuation of Ztore:

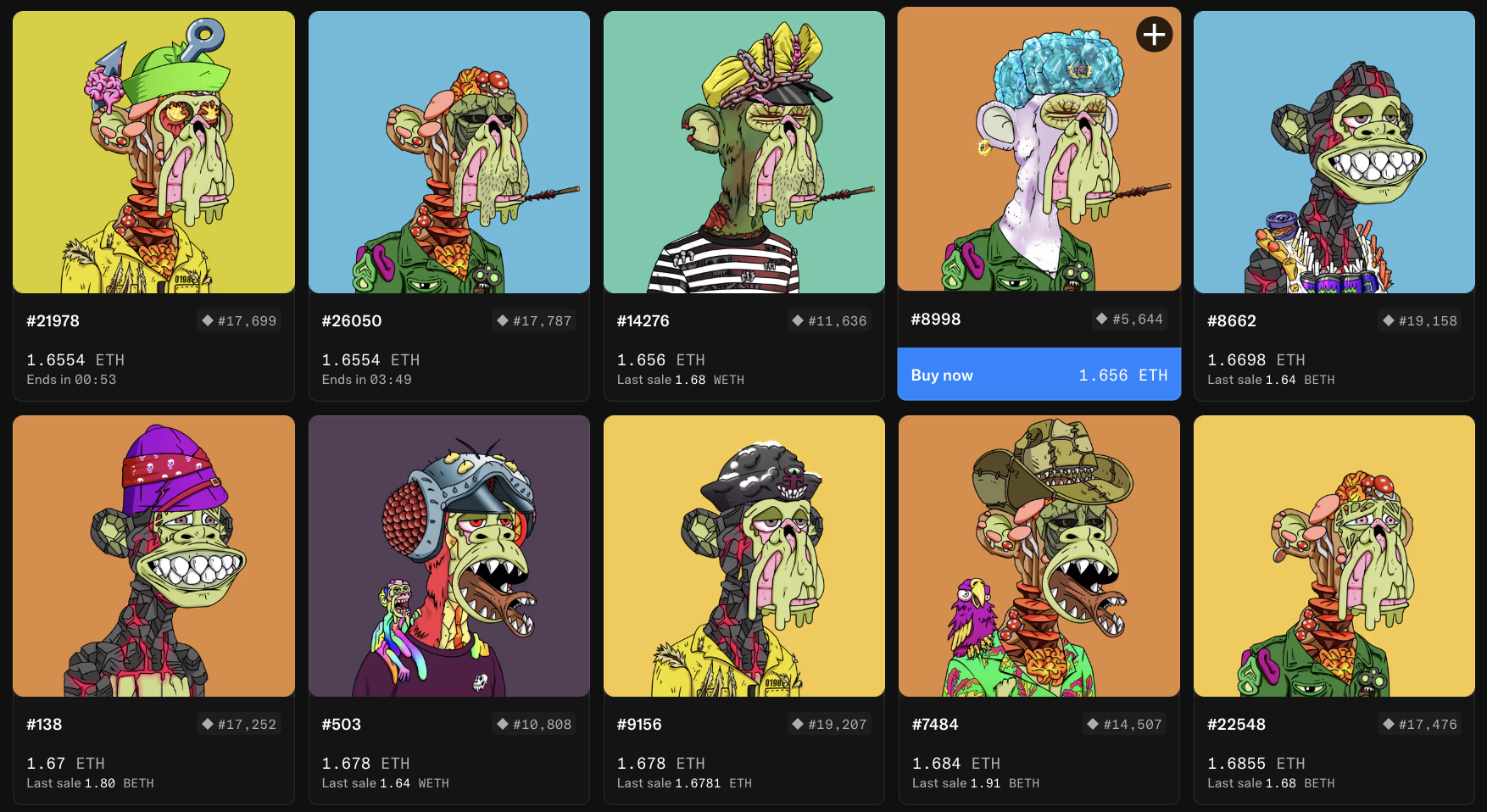

1. Growing e-commerce revenues: TVB’s average monthly e-commerce revenues grew several-fold from HK$29 million in 2020 to HK$238 million in 2021 after the acquisition.

2. Increased investment in content and production talent. The acquisition led to increased investment in content and production talent, which could potentially boost the value of the e-commerce business[1].

3. Strategic partnership with Shaw Brothers: TVB joined forces with Shaw Brothers to invest HK$200 million in Ztore, which could have contributed to the high valuation.

Despite these factors, the acquisition has not been a successful investment for TVB. The company posted a record loss of HK$647 million in 2022, partly attributed to the acquisition of Ztore. TVB’s net loss for 2021 was HK$281 million, compared to HK$295 million in 2019. The Ztore acquisition has not yet turned a profit, and the company’s financial situation remains challenging.

In conclusion, the acquisition of Ztore by TVB was a risky investment that has not yet shown positive results. The high valuation of Ztore at the time of the acquisition may have been influenced by factors such as growing e-commerce revenues, increased investment in content and production talent, and the strategic partnership with Shaw Brothers. However, the investment has not translated into profitability for TVB, making it a questionable decision from the beginning.

The decision to acquire such a large stake in ZStore was an unusual strategic move for a TV franchise. While TV shopping has been a longstanding industry, the primary strength of TV media does not lie in the sale of merchandise. In my opinion, TVB should have made a smaller strategic investment in the deal, perhaps at 20% with one board seat, which would have been sufficient for TVB as a listed company to have a skin in the game. Venturing into such a bold and risky investment (majority) in a startup that has yet to prove its ability to withstand economic downturns is not only irrational but also failed poorly in maintaining clear vision on how to transform the TV franchise. In summary, the previous board members and leadership team of the company should be held accountable for exposing the shareholders’ fortunes to unnecessary risk, which could have been avoided with a more cautious approach.

More about Skin in the game in future blogposts.

References

1. TVB acquires Ztore, joins forces with Shaw Brothers to invest HK$200m https://www.marketing-interactive.com/tvb-acquires-ztore-joins-forces-with-shaw-brothers-to-invest-hk200m

2. TVB and Shaw Brothers acquire 75% of Ztore for HK$200 million to expand e-commerce business https://corporate.tvb.com/article/4254e54d7b7abcecb52b33aecb939cc5.html