The Perilous Path of Trend-Chasing Leadership: A Case Study of Arta TechFin

Arta TechFin Stock code: 279

In the dynamic world of business, leadership is often the linchpin that determines the fate of a company. This is particularly true in industries that are as volatile and innovation-driven as technology and art. The story of Arta TechFin, a Hong Kong-listed company (HK stock code 279), serves as a compelling case study on how leadership styles, particularly those inclined towards trend-chasing, can significantly impact a company’s trajectory. At the time of this posting, the chairman Adrian Cheng has already resigned from his position and had also trimmed down its stake according to news published on Jan 3, 2024 (link)

The White Knight Rescue by Adrian Cheng

Arta TechFin’s journey took a dramatic turn when Adrian Cheng, a renowned entrepreneur, stepped in as a white knight, saving the company from financial distress. Cheng’s intervention was not just a financial bailout; it was a strategic move to relaunch Arta TechFin as a hybrid entity straddling the worlds of technology, art, digital assets, and investment banking. This pivot aimed to position the company at the forefront of the burgeoning NFT (Non-Fungible Token) market and the digital art scene, areas where Cheng had already made significant inroads with his K11 entrepreneurship ventures[13][17].

Leadership and Vision: The Double-Edged Sword

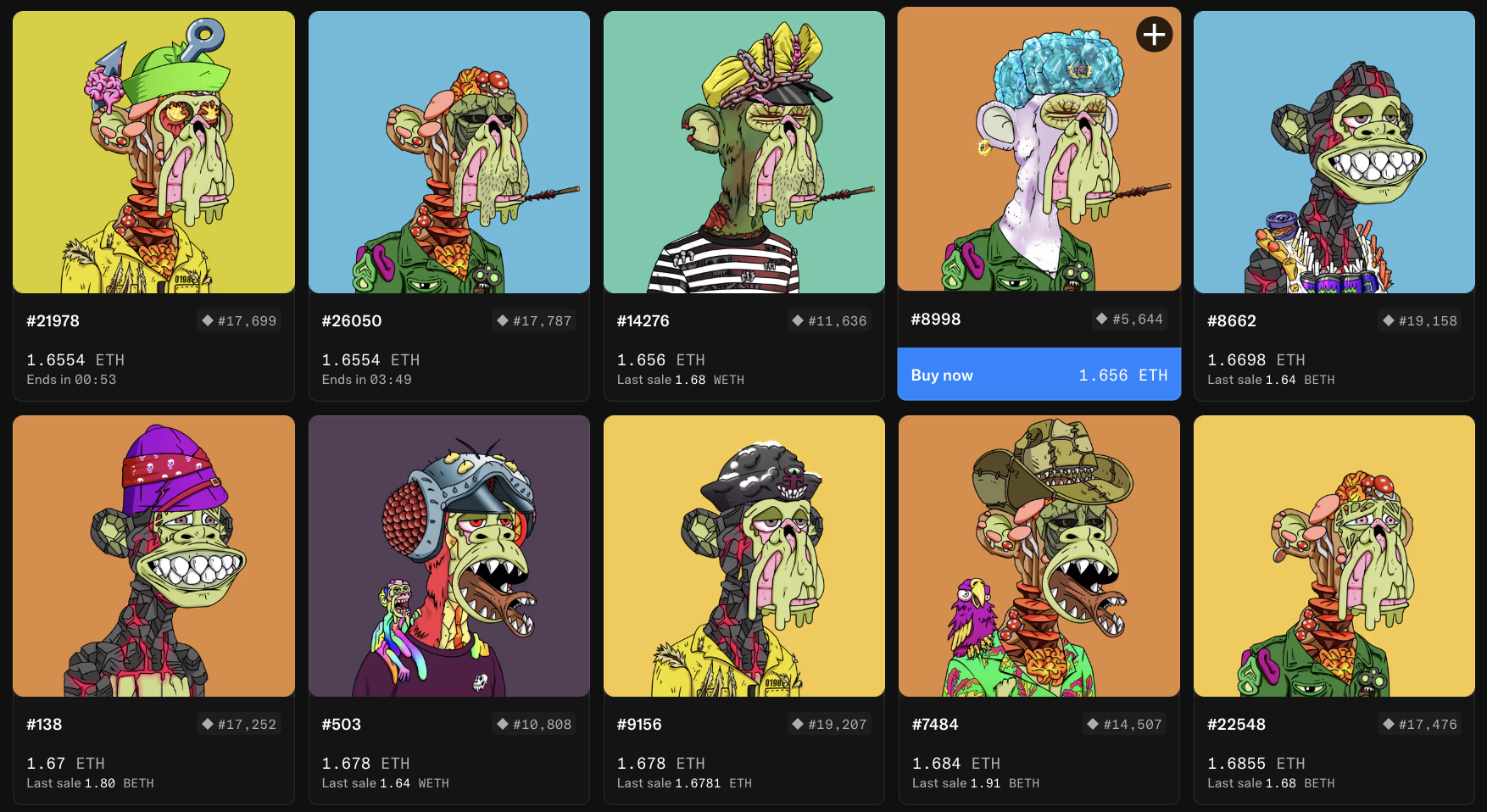

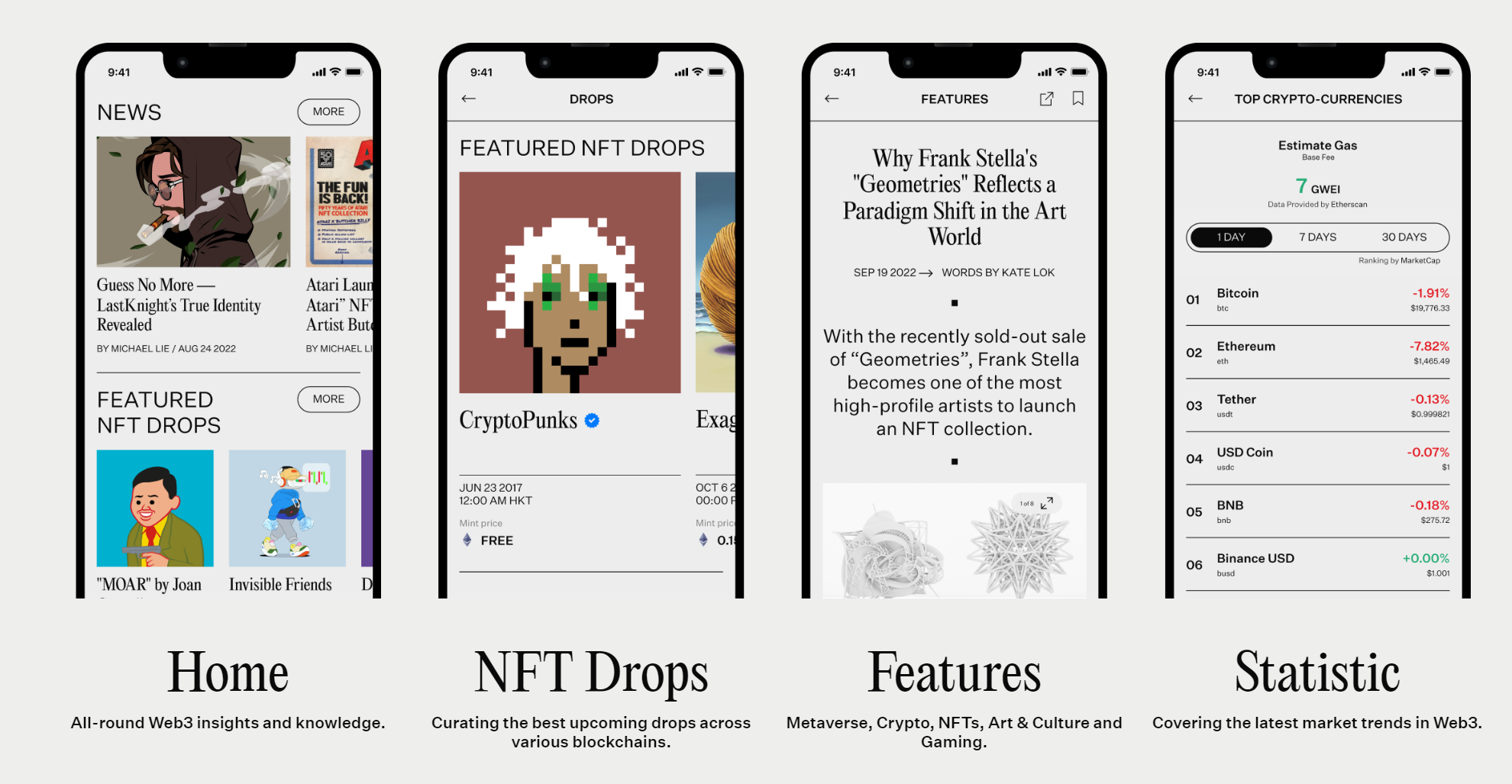

Under Cheng’s leadership, Arta TechFin embarked on ambitious projects, including the launch of ARTazine, a platform envisioned to be both an NFT marketplace and a lifestyle brand. This move was indicative of Cheng’s leadership style, characterized by a keen eye for trends and a bold approach to innovation[13][17]. However, the venture into the NFT space, fraught with challenges such as rug pulls and scams, raised questions about the strategic direction Cheng was steering the company towards[13][17].

Eddie Lau, appointed CEO in the wake of the company’s restructuring, brought with him a wealth of experience in investment banking and a mandate to navigate Arta TechFin through its new strategic direction. Despite his professional background, Lau’s understanding of the art market and the intricacies of the art industry was perceived as lacking. This gap in expertise, coupled with a leadership style that aggressively pursued the launch of ARTazine, ultimately led to the platform’s downfall. The defunct status of ARTazine, with its inaccessible iOS and Android apps and website, stands as a testament to the challenges faced by the company[13][17].

The Consequences of Trend-Chasing Leadership

The leadership at Arta TechFin, characterized by a penchant for jumping onto the bandwagon of emerging trends, has had tangible consequences for the company. The market capitalization and stock prices of Arta TechFin have reflected the tumultuous journey the company has undergone in the last 24 months. This outcome underscores the risks associated with leadership styles that prioritize trend-chasing over a deep understanding of the industry and market dynamics[13][17]. Check this youtube video which is about 2 years old about the the company https://www.youtube.com/watch?v=ph5V0xBuvl0

Lessons Learned

The story of Arta TechFin and its leadership under Adrian Cheng and Eddie Lau offers valuable lessons for businesses navigating the intersection of technology and art. While embracing innovation and trends is crucial, it is equally important for leadership to possess a deep understanding of the industry they operate in. Moreover, a successful pivot requires not just vision but also a strategic approach grounded in market realities and a clear understanding of the company’s core competencies.

As Arta TechFin continues its journey, the company’s experience serves as a cautionary tale on the importance of leadership that balances innovation with insight, trend-chasing with strategic foresight. The future of companies operating at the cutting edge of technology and art will likely depend on their ability to navigate these complexities with a leadership style that is both visionary and grounded.

In my opinion is as both a scholar, engineer and art curator, the art market will need to use custodian services and other FinTech (like eKYC, tokenization) services to add more liquidity to proven art collections (especially on authentication technologies) and certainly not counting on NFTs. NFTs are still by and large a derivative product at best with some digital addresses and keys. A marketplace for NFTs will not create extra value to the industry nor does it solves the pain points of the artist and art dealing industry.

This blogpost has been edited by myself with the help of Generative AI GPTs. I do write a lot myself and this is entirely my opinion. You can also check out my published paper on how I view Art Tech and the use of blockchain technologies – published last year at the ARTS Journal by MDPI.

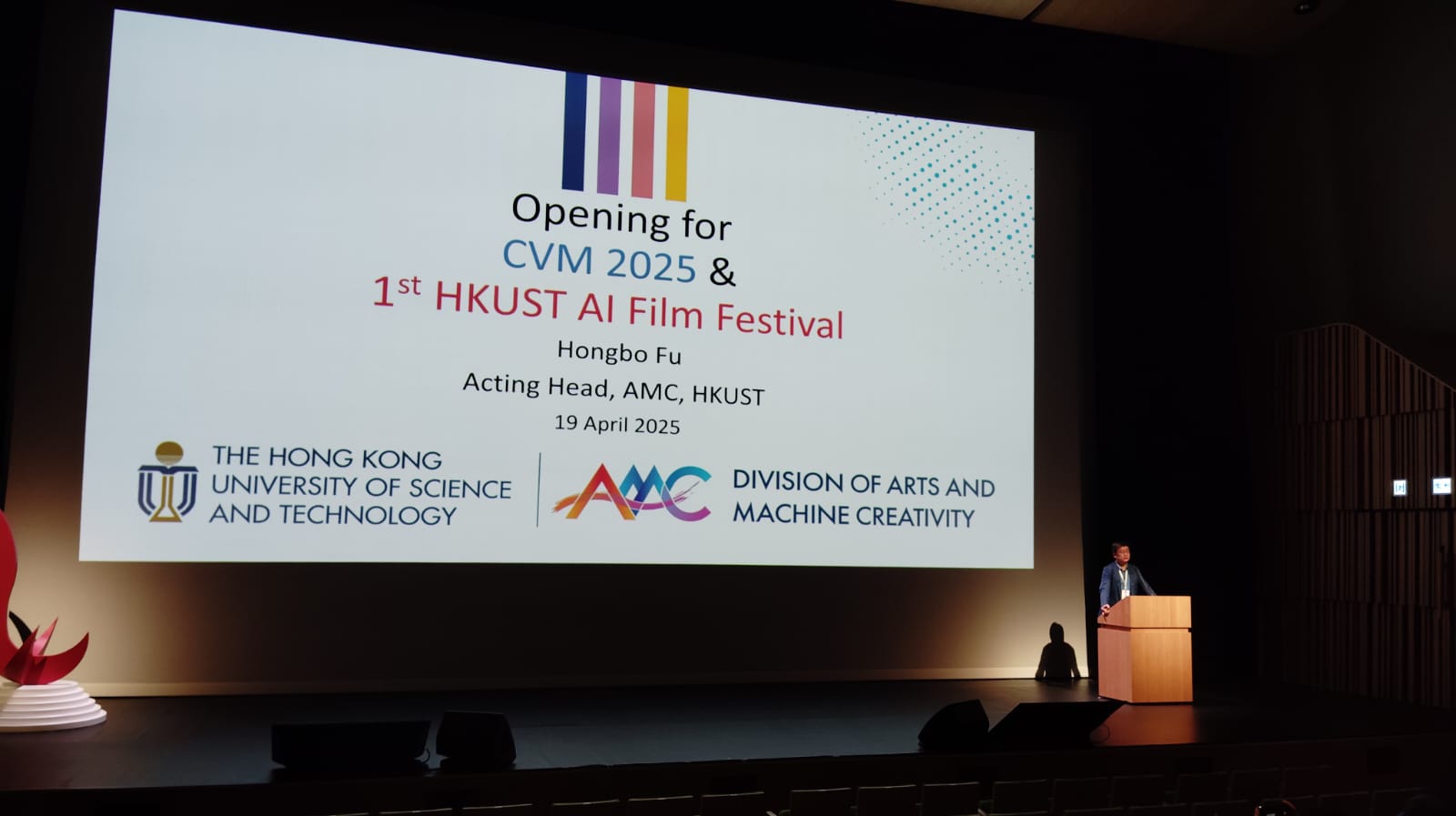

When the NFT Hype Settles, What Is Left beyond Profile Pictures? A Critical Review on the Impact of Blockchain Technologies in the Art Market

https://repository.hkust.edu.hk/ir/Record/1783.1-128643

Next, I will dive into the Generative AI and Digital Art market – (sorry not NFT), just Generative AI for the Art industry.

Citations:

[1] https://markets.ft.com/data/equities/tearsheet/summary?s=279%3AHKG

[2] https://www.artatechfin.com

[3] https://markets.ft.com/data/equities/tearsheet/profile?s=279%3AHKG

[4] https://www.cnbc.com/quotes/279-HK

[5] https://www.marketscreener.com/quote/stock/ARTA-TECHFIN-CORPORATION–6165781/

[6] https://www.marketwatch.com/investing/stock/279?countrycode=hk

[7] https://www.cbinsights.com/company/arta-techfin

[8] https://www.gq-magazine.co.uk/lifestyle/article/adrian-cheng-interview

[9] https://www.artatechfin.com/investor-relations/esg

[10] https://www.townandcountrymag.com/society/money-and-power/a40979252/adrian-cheng-interview-philanthropy-hong-kong-2022/

[11] https://thepaypers.com/interviews/introducing-atomic-settlement-via-programmable-payment-and-tokenized-fund–1265741

[12] https://www.amfar.org/honorees/adrian-cheng/

[13] https://www.scmp.com/business/banking-finance/article/3170310/arta-techfin-looks-blockchain-finance-after-restructuring

[14] https://finance.yahoo.com/quote/0279.HK/

[15] https://www.barrons.com/market-data/stocks/279?countrycode=hk

[16] https://www.artatechfin.com/media-centre/press-post/Arta-TechFin-Developing-Regulated-Interoperable-Fund-Tokens-on-Major-Chains-Will-Collaborate-With-Chainlink-Labs-to-Use-Chainlink-Services-and-Will-Deliver-Fiat-Based-Investment-Returns-to-Arta-TechFin-Clients

[17] https://www.moomoo.com/stock/00279-HK/company

[18] https://osl.com/media-coverage/arta-techfin-partners-osl-virtual-asset-financial-service-ecosystem/