Our three strategic recommendations to develop more IP in Hong Kong

Following on from last article about R&D Investment for Hong Kong article here

In the last ten years, one of the achievements of the current government in promoting innovation and technology (I&T) is the increase of research and development (R&D) expenditure as a percentage of gross domestic product (GDP) from 0.74% to 0.99% during the five-year term. However, this is still not reaching the original goal of 1.5%. The government has stepped up its financial support to develop I&T, but the investment is far from enough to enable us be ranked among the top amongst global competition. The success of Israel, nicknamed “start-up nation”, is mainly contributed by the continuous investment in R&D of innovative and high technology over the past five decades. Since the 1970s, the country has been keen on developing I&T. In 2018, its R&D spending accounted for 4.94% of GDP, over twice the Organization for Economic Cooperation and Development (OECD) average of 2.26%. During the COVID-19 pandemic, modest adverse impact was seen in Israel compared to other developed countries. However, the high-tech companies today already account for 40% of Israeli Tel Aviv Stock Exchange 35 Index (or TA-35, similar to the Hang Seng Index in Hong Kong), and contribute more than 40% of the country’s exports. Though workers in high tech companies only account for 10% of the labour force, they provide 25% of Israeli income taxes. Shenzhen also drives economic growth through R&D in I&T. In 2020, the local R&D expenditure accounted for 5.46% of GDP. If Hong Kong wants to breakthrough in this field, the relative investment in R&D must be persistent and intensified. Therefore, the government should increase R&D spending to at least 1.5% of GDP in the next few years. Otherwise, in today’s fierce global competition in I&T, slow advancement in this area will only lead to slow down.

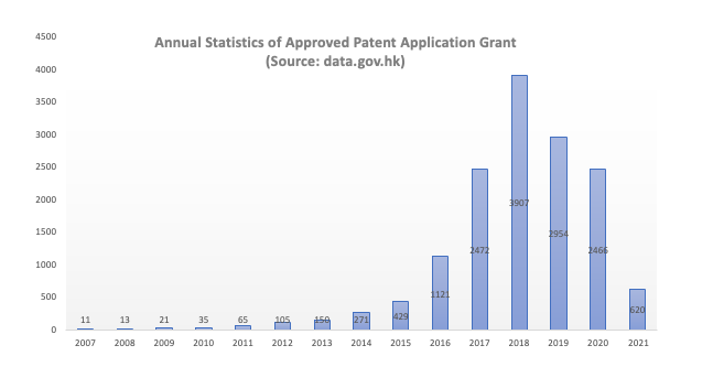

According to data from the Hong Kong’s open data portal, the following chart shows that there is indeed a negative growth in the number of applications granted for Patent Application Grant (PAG) being offered by the HKITF for supporting the Hong Kong’s industry to innovate.

We have the following three strategic recommendations :

Recommendations# 1) Set up an IP platform entity (a government-owned limited company) to help actively seek licensees from Hong Kong and overseas to commercialise the different intellectual properties rather having each institute trying to manage their own commercialisation effort. Ideally, this should be setup with industry stakeholders like various trade associations and chambers of commerce. This new platform entity should be operated as a limited company similar to HK Education City Limited.

Recommendations# 2) One of the recommendations is to lower the royalty license fee (or subsidised by another new ITF funding) currently being charged by various universities and research centres. An invention in itself is difficult to receive a valuation unless the product or service offerings are commercialised. This commercial negotiation process is often plaguing the process of the investor and technology/patent owner. This has been specifically brought up as an issue during a recent forum with representatives from over 20 technology related trade associations.

Recommendations# 3) Enhancing the current patent application grant (PAG) being offered to Hong Kong company and citizens by doubling or tripling the offer today. Currently, an individual or a company can only apply for one PAG per lifetime. The data already shows that there is a slowdown in growth in PAG applications. Companies that have success in applying PAG are more likely to have success and great inventive ideas that are patentable.

The above recommendations are not by any means a concrete operating plan but serve as a reminder that IP development and technology innovations does need the Government to provide continuous support (as in Israel and Korea) mentioned earlier in this chapter. There is evidently a trend of negative growth from within the industry itself and this contradicts with promoting Hong Kong as a technology hub and IP Hub. SCC highly recommend Innovation and Technology Fund (ITF) to work closely with HK Intellectual Property Department to plan ahead for the KPIs require to increase the rate of commercialisation and generation of intellectual property from Hong Kong-based companies and research centres. The increase of output in this area will directly impact the output of any effort in re-industrialisation, technology transfer, providing employment and ultimately economic output for Hong Kong.

This is part 2 of a report that has been written by the contributing editor Daniel Chun for Smart City Consortium in their advisory report for Smart City Blueprint 3.0 – the original link to report Ch. 5 could be found here

Reference

https://news.rthk.hk/rthk/ch/component/k2/1650162-20220525.htm

https://www.info.gov.hk/gia/general/202206/01/P2022060100329.htm

https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS?locations=IL-CN-KRCH&most_recent_value_desc=true

https://www.timesofisrael.com/imf-says-israel-managed-pandemic-exceptionally-well-warns-of-significantrisks/

https://innovationisrael.org.il/sites/default/files/The%20Israel%20Innovation%20Report%202021.pdf

https://data.gov.hk/en-data/dataset/hk-itc-team1-annual-itf-approved-pag-stat

https://www.itf.gov.hk/en/funding-programmes/fostering-culture/pag/index.html

https://www.edcity.hk/hq/en/content/aboutus